Link to this post for sharing:

Urban Economics on the Ground

Had an interesting "Forum" on Growth & Transportation last Sunday (April, 23, 2017). My statements that there are limits to growth and that building more housing does NOT make housing cheaper drew "decidedly mixed" responses - real anger from some, hearty "thank you!" from others.

What follows is an explanation of why this is true.

Greater Density = Higher Prices

"First an increase in the population size has fairly straightforward effects. Indeed, a rising population makes competition for land fiercer, which in turn leads to an increase in land rent everywhere [emphasis added] and pushes the urban fringe outward. This corresponds to a well documented fact stressed by economic historians. Examples include the growth of cities in Europe in the 12th and 19th centuries as well as in North America and Japan in the 20th century or since the 1960s in Third World countries." (From page 83 section 3.3.2: Economics of Agglomeration:... by Fujita, Thisse).

Background:

Some disagreement to what I and others said came from tweets by a Ms. Kim Mai Cutler as reported in "SF Curbed" here:

http://sf.curbed.com/2017/4/24/15407822/housing-cupertino-town-hall-silicon-valley

with a follow-up conversation here:

http://sf.curbed.com/2017/4/25/15425050/sunnyvale-housing-growth-apple-goldman

Kim Mai Cutler wrote on housing in San Francisco for TechCrunch:

https://techcrunch.com/2014/04/14/sf-housing/

Her contact/bio info is here:

https://www.allamericanspeakers.com/speakers/Kim-Mai-Cutler/394419 .

Ms. Cutler's tweets raise points one hears a lot so... to answer I'll get into the basics of Urban Economics and why higher density leads to higher housing costs. At the end I'll describe what should happen in the SF Bay Area and then what will happen.

(This is follow-up to my earlier posts explaining very simply why building more won't lower rents here: http://meetingthetwain.blogspot.com/2017/01/live-work-commute-2.html and here: http://meetingthetwain.blogspot.com/2017/02/is-there-housing-crisis.html )

with a follow-up conversation here:

http://sf.curbed.com/2017/4/25/15425050/sunnyvale-housing-growth-apple-goldman

Kim Mai Cutler wrote on housing in San Francisco for TechCrunch:

https://techcrunch.com/2014/04/14/sf-housing/

Her contact/bio info is here:

https://www.allamericanspeakers.com/speakers/Kim-Mai-Cutler/394419 .

Ms. Cutler's tweets raise points one hears a lot so... to answer I'll get into the basics of Urban Economics and why higher density leads to higher housing costs. At the end I'll describe what should happen in the SF Bay Area and then what will happen.

(This is follow-up to my earlier posts explaining very simply why building more won't lower rents here: http://meetingthetwain.blogspot.com/2017/01/live-work-commute-2.html and here: http://meetingthetwain.blogspot.com/2017/02/is-there-housing-crisis.html )

Discussion:

Below is the "standard model" for urban economics. It shows that the further you are from the city center, the lower the density. This originated with von Thunen (1826) and has held up remarkably well with appropriate modifications for advancements in technology and economic research.

The above graph comes from (2015) "SPATIAL DISTRIBUTION OF LAND PRICES & DENSITIES - The Models Developed by Economists" by Alain Bertaud at NYU - former principal urban planner at the World Bank. He wrote the paper specifically to teach basic economics of cities to urban planners. His (very readable) paper is available for download at:

http://marroninstitute.nyu.edu/content/working-papers/the-spatial-distribution-of-land-prices-and-densities

http://marroninstitute.nyu.edu/content/working-papers/the-spatial-distribution-of-land-prices-and-densities

About this graph, Mr. Bertraud writes "...an increase in population, everything else being equal, would increase both land prices and densities." In his paper he shows similar charts for many other major cities.

Housing costs must be understood in relationship to income in the region/country. Central Jakarta may be much cheaper than central NY City in dollars. Compared to incomes in Indonesia it will be more expensive than distant suburbs. Housing costs for each city must be considered relative to salaries in that area. See below (click to enlarge graph).

Speaking of NYC, at the forum I said "if building more lowered prices, NYC and Hong Kong would be the cheapest cities in the world." Ms. Cutler questioned this. The above graph seems to agree with me.

To bring this home we compare the prices of a 4 Bedroom, 2,000 sq. ft. domicile in Manhattan, vs. one in suburban Long Island:

East Islip in Suffolk County, suburban Long Island = $619K. One of the more expensive houses in the area. Most homes there (per Zillow) are more modest:

Same sized living space but now Manhattan - $2M:

And don't forget to add to your $7,780/mo. mortgage, the monthly Home Owner Association fee of $3,244 - which only goes up over time.

Here is what you can get in Manhattan for roughly the same $619,000 that 4 BR 2,000 SF house in Long Island cost. A 450 SF 0 BR (studio). with a HOA fee of $386/month.

So, yes, as her tweet said, the average housing unit in Manhattan NY is not much off from Silicon Valley but apples-to-apples please. Your choice - 2,000 sq. feet and 4 bedrooms and drive to work or 450 SF 0 bedroom and take the subway. Which bears out yet another graph from Urban Economics:

The graph above says: "For the same price, you can have a big house far out or a small house further in." I.e., you can't have it both ways. The above graph is from Econ 137 (Urban Economics) taught at the (Ivy League) Univ. of Pennsylvania by Professor Ordonez, formerly of UCLA.

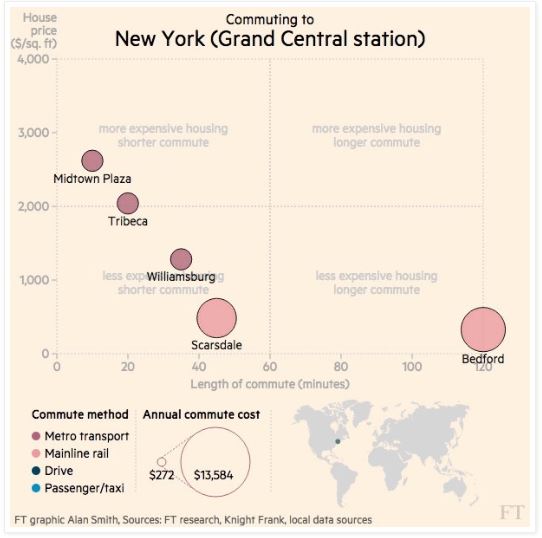

Here are rents courtesy of the London Financial Times - the closer to downtown (on the left) the higher the prices (click figure to enlarge):

|

| https://www.sas.upenn.edu/~ordonez/pdfs/ECON%20137/LN1-1.pdf |

Here are rents courtesy of the London Financial Times - the closer to downtown (on the left) the higher the prices (click figure to enlarge):

Graphs showing the same idea for many more cities here:

We can't compare costs in the 24-million-people NY metro area to the 7.5 million people in the SF-San Jose metropolitan areas since they have vastly different economic dynamics and income distributions. Costs must be considered relative to income in the same metropolitan area. We can compare SF central to other cities in the area.

Here are the rents for a 2 bedroom apt. in these cities (as of 1/7/2017):

San Francisco - $4,487

Palo Alto - $3,816

Mountain View - $3,549

Cupertino - $3,222

Sunnyvale - $3,173

Fremont - $2,500

Livermore - $2,093

San Francisco - $4,487

Palo Alto - $3,816

Mountain View - $3,549

Cupertino - $3,222

Sunnyvale - $3,173

Fremont - $2,500

Livermore - $2,093

We can see clearly that rents in the SF Bay Area follow the "Standard Model". And so does NYC as seen below with lower Manhattan commanding higher prices which decrease as you get further away:

Let's look at what happened to NYC over time. NYC reached a relatively stable population of around 8M in 1950s. Manhattan peaked in population around 1910-1920 at 2.3M and has declined most of the time since then to currently 1.6M. Brooklyn peaked in 1950.

What happened to Manhattan? A lot of immigrants came in the 1910s and crowded into tenements until they could establish themselves. Then, as their economic situation improved and transportation got easier with subways and motorbuses they moved into the suburbs of Brooklyn, Queens, and the Bronx. (This is a perfect example of the logistic curve ("limits to growth") covered more extensively here: http://meetingthetwain.blogspot.com/2017/04/limits-to-growth.html )

Housing was expensive in Manhattan per square foot but cheap per person despite the density because the demand side of the equation didn't have much money.

You can cram a lot of people into 2 BR tenements - boys in one bedroom, girls in another, mom and pop in the living-kitchen-dining room.

If Apple, Facebook, and Google were importing thousands of minimum wage workers the same might happen here.

As soon as they could afford a nice home in the suburbs of Brooklyn, etc. they fled Manhattan. The subways (built in the 1890s) allowed them cheap, easy transport from a suburban home in Brooklyn or Queens into the job center of Manhattan.

What happened to Brooklyn when it's population peaked in 1950? The US was booming. Everyone got a car. And the sons and daughters of those who had migrated from Manhattan to the suburbs in Brooklyn and Queens? They now themselves migrated from Brooklyn to the suburbs in Long Island and New Jersey.

In both cases, cheaper and more convenient transportation resulted in people going out further for cheaper housing with more space.

The SF Bay Area is not unique. Everything you hear around SF you hear in other places like Raleigh, NC - "housing costs are outrageous!! I can't afford $300,000 for a house in the city! I'm moving to the suburbs!!" What has happened to housing in the US in general looks a lot like a bubble. Some of this is because so many left the construction trades or retired during the years of the Great Recession and were not replaced so there is a shortage of workers.

It could get worse as it did in 2007-2008. The last graph was of just SF - here is another view for the entire US below - crash coming?

Let's look at what happened to NYC over time. NYC reached a relatively stable population of around 8M in 1950s. Manhattan peaked in population around 1910-1920 at 2.3M and has declined most of the time since then to currently 1.6M. Brooklyn peaked in 1950.

What happened to Manhattan? A lot of immigrants came in the 1910s and crowded into tenements until they could establish themselves. Then, as their economic situation improved and transportation got easier with subways and motorbuses they moved into the suburbs of Brooklyn, Queens, and the Bronx. (This is a perfect example of the logistic curve ("limits to growth") covered more extensively here: http://meetingthetwain.blogspot.com/2017/04/limits-to-growth.html )

Housing was expensive in Manhattan per square foot but cheap per person despite the density because the demand side of the equation didn't have much money.

You can cram a lot of people into 2 BR tenements - boys in one bedroom, girls in another, mom and pop in the living-kitchen-dining room.

|

| Day care in 1910 http://philadelphiaencyclopedia.org/archive/settlement-houses/ |

As soon as they could afford a nice home in the suburbs of Brooklyn, etc. they fled Manhattan. The subways (built in the 1890s) allowed them cheap, easy transport from a suburban home in Brooklyn or Queens into the job center of Manhattan.

|

| Queens, NY ca. 1882 - Before the NY Subway opened it up. |

|

| Levittown, Long Island, 1955 |

The SF Bay Area is not unique. Everything you hear around SF you hear in other places like Raleigh, NC - "housing costs are outrageous!! I can't afford $300,000 for a house in the city! I'm moving to the suburbs!!" What has happened to housing in the US in general looks a lot like a bubble. Some of this is because so many left the construction trades or retired during the years of the Great Recession and were not replaced so there is a shortage of workers.

It could get worse as it did in 2007-2008. The last graph was of just SF - here is another view for the entire US below - crash coming?

I pointed out Hong Kong is also dense and also expensive. Ms. Cutler then tweeted that half of the housing there is public housing. Kind of proves my point doesn't it? If half of the population can only afford to live there because the other half is subsidizing their housing doesn't that mean that very dense Hong Kong is prohibitively expensive? I am not clear what her point is.

I mentioned a lot of anger about rents and house prices. I am not a psycho-analyst but I will guess it comes from three things.

1. "I did all the right things - got a degree, a good job, married a nice person who also has a good job and I can't afford a nice house near work. What am I supposed to do??" This is a legitimate question. Unfortunately the only options are to either wait out the bubble (which I did - it took years), commute a long distance (I did that for years), or get a job in an area you can afford. Sacramento, Denver, Seattle... People move. It isn't the end of the world.

2. "It is so unfair that these people just like me got a house when it was cheaper" Housing was cheaper but it was still in line with what professionals and engineers can afford. When I bought my house in 1991, I was a senior software engineer and my wife was a mid-level engineer. A real estate bubble had just popped. We bought a "fixer-upper" with 20% down from 5 years of saving. If we were at the same career stage working for Google or Microsoft in this area, our combined salary would be able to afford the same house under the same conditions. Housing is up a lot, it is the middle of a bubble, but market rates are determined by what people can afford. If enough people can afford an expensive house, that is what they will cost. A single working engineer could never afford a house in the middle of Silicon Valley. It has always taken two good incomes to afford a house in Silicon Valley or San Francisco or a single very good income. If you were told otherwise you were mis-informed.

3. "If only these people would allow more building rents and housing prices would drop." The entire point of this blog post is to explode that myth. It isn't true and has never worked anywhere, ever.

|

| "Build more and it will get cheaper" also known as "There's a sucker born every minute" - PT Barnum |

I cover much more of the theory here:

http://meetingthetwain.blogspot.com/2017/02/is-there-housing-crisis.html

and here:

http://meetingthetwain.blogspot.com/2017/01/live-work-commute-2.html

What If Housing Costs Dropped in Half?

So what would happen if housing costs dropped in half? Assume that with my magic wand I instantly cut all rents and housing prices in half. Not only that but rents and housing prices will only go up 2%-4% a year.

All those who scrimped and saved to buy a house within the last 10 years find that their $1.6M house is now worth $800,000. They will turn the keys over to the bank and walk away since it will take 15 to 30 years for the house to get back to what they paid for it. All those builders who just finished all those nice new apartment complexes would declare bankruptcy and do the same - and that means virtually every builder in the area. Most had to take out loans to buy the land and put up the buildings and at half the rental income there is no hope whatever of making it back for the 30-year duration of the loan. With so many foreclosures and loan defaults, the banks would be in desperate shape and require massive bailouts from the federal government. Property taxes would drop in half as well, so libraries would close, teachers would be laid off, and schools would be packed 60 kids to a class room.

Having sustained such enormous losses, banks (any that are left) would be very reluctant to make loans for home buying. This is precisely what happened in Spain and Portugal during the 2003-2007 housing bubble. The housing bubble burst - prices and rents collapsed, unemployment soared to 25% in those countries for years - banks were left with huge loan losses.

Spanish Unemployment 25% as Housing Bubble Burst

With house building stopped, furniture and appliances don't get sold, so manufacturing stops, people lose their jobs, and the GDP contracts. In Spain the GDP per person went down for most of the 8 years 2007 - 2015 as seen below.

Spanish GDP Drops for 8 Years

We have seen this before.

It was called the Great Depression. Not fun.

The best we can hope for is for prices to go sideways. In my 35 years in the SF Bay Area I've seen that over and over. Prices shoot up, everyone starts talking about how much their house is worth or how little rent is back in Grand Rapids, Mich. Then all the startups that threw venture capital money around like it was chewing gum (and bid up prices on land), either flame out or their revenues flat-line. House prices and rents come down a little, maybe 10% to 15%, over 3 or 4 years. Then prices/rents stay flat for the next 5-7 years until the next big surge in startups. Rinse, repeat.

But you don't have to assume an instant 50% drop in price/rent. Even a 10% drop is going to have a significant effect. No housing builder will know how far down prices will go. They will finish up whatever they started and put on hold anything that hasn't broken ground. During recessions in the SF Bay area I've seen the bigger builders with deep pockets sit on properties for 10 years waiting for the market to justify going back in.

Banks will also be wary of loaning too much on housing since they won't know how much further housing prices might drop and wouldn't want to get stuck with bad loans. Banks will then require more down payment and become more selective in whom they loan to. This will further reduce the pool of those bidding on housing and housing prices will decline a little more to some point where they stabilize - maybe 15% to 40% below the peak. Housing is a huge part of the economy and this will be the start of a recession. The lower end of the housing market will drop more than the middle since those are the more marginal buyers who are more likely to have trouble making payments if they are laid off.

Why Move Here?

So why do people migrate to dense, expensive areas? Because of jobs. Companies benefit from agglomeration in having all their workers, managers, marketers, and scientists together. Agglomeration increases innovation and productivity - up to a point.

The graph below is from "Urban Economics" by O'Sullivan, 8th edition (standard undergraduate text). Note it shows that increasing the number of workers increases the costs of living in the city. It also shows a point of diminishing returns to a company in having all its workers near each other. There is an optimal equilibrium population. Less than that is not as innovative. More than that makes it too expensive to hire and house workers; the additional return on investment isn't enough to justify the increased density (= living costs). (click on graph to enlarge).

This ties into what I explained in a previous blog about the carrying capacity of a region being governed partly by the logistic equation seen below:

Carrying capacity for most species is simply food. For 21st century humans it includes jobs, transport, shelter. I covered this in more detail in limits to growth:

Schools

Ms. Cutler also had a tweet on school enrollment declining as evidence that we must build more housing. Evidently some school bureaucrat somewhere said enrollment was declining because housing was too expensive here. Therefore, we should build more to lower costs so more families with kids can live here.

Below is San Jose Unified's school enrollment over the years. The bottom of the right hand axis starts at 30,600 so the swings in enrollment aren't as dramatic as first appears. At the moment, we are pretty much in the middle. The maximum difference is 2,394 = 7.8% swing from minimum to maximum. So we are about 4% from the top and 4% from the bottom. Not a big deal.

Below is San Jose Unified's school enrollment over the years. The bottom of the right hand axis starts at 30,600 so the swings in enrollment aren't as dramatic as first appears. At the moment, we are pretty much in the middle. The maximum difference is 2,394 = 7.8% swing from minimum to maximum. So we are about 4% from the top and 4% from the bottom. Not a big deal.

I suppose the build-build-build people were saying from 2000 to 2007 that we must build more because of declining enrollments, while from 2007-2012 they were saying we must build more because of increasing enrollments to accommodate all the new families. Since 2013 it is back to build, build, build because of declining enrollments.

Are Sunnyvale and Cupertino's school enrollment different? Yes. Cupertino's looks like Sunnyvale's so we'll just show Sunnyvale. See below (click on graph to enlarge).

What could explain the above graph? A lot of things. Maybe a rapid influx of families overcrowding schools through 2014 then moving their kids to private schools in 2014 through 2017? Or so many new families moved in that prices got too high and they couldn't afford it and had to move out? Or maybe they move to Silicon Valley for a job, find an apartment, then later find a single family house in Fremont or Livermore? Maybe lots of single people move in - double up with 4 in a single family house or town-home - fewer kids? If you think one guy from the local school system has any special insights then you haven't met a lot of school bureaucrats - they are nice people who care about kids. They typically don't know any more about urban economics than the average person - i.e., nothing.

Looking at the school enrollment by grade for San Jose, Santa Clara County, and California, we see no particular population bulge in any year. It is not as if all the new residents just had kids yesterday that will all over-crowd the schools at once. People move around, finding the optimal location for themselves in terms of cost and commute. (click to table enlarge)

So why here? Why Silicon Valley? Yeah, the climate is good here but plenty of people love the four seasons in the East and Mid-West - lovely fall colors, ice fishing & cross country skiing, sailing on the lakes in Summer, etc.

The good Wisconsin farmers, Michigan auto workers, Indiana steel workers are spending $200,000+ to educate each engineering graduate in their state schools. Those great land grant universities in Madison, Ann Arbor, and other towns produce many thousands of engineers yet half of those engineers move to California to find jobs. We are draining intellectual resources and brilliant people from the heartland. Maybe the venture capitalists that made the SF Bay Area so successful could make their magic happen in the "Rust Belt". Midwesterners could stay where they grew up, and the country could rebuild it's core.

We are taking from that part of the country the very innovators and STEM people needed to rebuild it. As a result we get a divided country, and a lot of people voting their anger and despair at the loss of their future and their children.

The cause? The venture capitalists in Palo Alto don't want to go far to visit their start-ups in the early phase, why should they? So the startups are all on the peninsula. Once those startups become successful and enter high growth phase they don't want to move, why should they? Once their high growth phase is over and they have to start watching the pennies, they expand elsewhere, or get bought up like Sun Micro, or flame out and go out of business like more companies than I can count. Then yet more startup cos. enter their high growth phase. Rinse, repeat.

I greatly respect Congressman Ro Khanna for going to the former coal country of Kentucky and meeting with their elected representatives to try to help them with the magic that has made the SF Bay Area so dynamic.

This is not a zero-sum game, folks. If Kentucky (which is a beautiful state, by the way) and the other parts that helped build this country can become centers of innovation, it doesn't mean Silicon Valley and SF will stop innovating. The more minds working to solve the problems humanity faces, the better off we all are.

More on Congressman Ro Khanna's visit to Kentucky here:

http://www.politico.com/story/2017/03/trump-election-silicon-valley-ambassador-appalachia-ro-khanna-236486

|

| Lake Okojobi in Iowa |

|

| Purdue University Engineering Quad |

The cause? The venture capitalists in Palo Alto don't want to go far to visit their start-ups in the early phase, why should they? So the startups are all on the peninsula. Once those startups become successful and enter high growth phase they don't want to move, why should they? Once their high growth phase is over and they have to start watching the pennies, they expand elsewhere, or get bought up like Sun Micro, or flame out and go out of business like more companies than I can count. Then yet more startup cos. enter their high growth phase. Rinse, repeat.

I greatly respect Congressman Ro Khanna for going to the former coal country of Kentucky and meeting with their elected representatives to try to help them with the magic that has made the SF Bay Area so dynamic.

|

| Kentucky - Cumberland Falls |

|

| Ro Khanna visiting Kentucky |

http://www.politico.com/story/2017/03/trump-election-silicon-valley-ambassador-appalachia-ro-khanna-236486

Transport

Ms. Cutler also raised the issue in the transport area of self-driving cars (100% electric, powered from home solar panels, please). No one knows for sure when or how that will work out, but if past experience and academic research is any guide, it will decrease the perceived cost of commuting as people can make productive use of their commute time. People will commute further because time in the car is not wasted - they can teleconference in, or work on their laptop, or eat breakfast.

Decreasing the cost of transportation has always resulted in more people fleeing the dense city for the more affordable (because less dense) suburbs. Silicon Valley will then have a lot of cheap housing and everyone will look at the horrible apartments jammed next to each other with zero set-backs and ludicrously inadequate parking and wonder what we were thinking.

And I'll say, "Good question. What were we thinking?"

Decreasing the cost of transportation has always resulted in more people fleeing the dense city for the more affordable (because less dense) suburbs. Silicon Valley will then have a lot of cheap housing and everyone will look at the horrible apartments jammed next to each other with zero set-backs and ludicrously inadequate parking and wonder what we were thinking.

And I'll say, "Good question. What were we thinking?"

Previous blogs related - c.f.:

1. Housing costs and density: http://meetingthetwain.blogspot.com/2017/02/is-there-housing-crisis.html

2. Dense areas cost more: http://meetingthetwain.blogspot.com/2017/01/live-work-commute-2.html ]