Housing Crisis?

Introduction:

A look at the Demand side of the Supply-Demand equation. We find that the current high demand that is driving up prices might subside if proper measures for transit and tax policies are implemented. Without those measures, the higher cost of housing in the SF Bay area and California will persist.

|

| 2008 Housing Crisis |

|

| 2017 Housing Crisis |

http://meetingthetwain.blogspot.com/2017/02/is-there-housing-crisis.html

In previous posts we looked at the Supply side of Housing's Demand-Supply equation and found increased supply would not lower costs, or even keep costs from rising. Cf., http://MeetingTheTwain.blogspot.com/2017/01/live-work-commute-2.html

Another exploration of this topic:

http://meetingthetwain.blogspot.com/2017/04/urban-economics.html

An update including the ups and downs of housing prices as of January, 2018:

https://meetingthetwain.blogspot.com/2018/01/housing-jan-2017.html

A lighter look: http://meetingthetwain.blogspot.com/2017/09/my-personal-housing-crisis.html

Job retraining, additional local public/private transit, and tax incentives for corporations to expand where skilled people and affordable housing already exist (i.e., not the SF Bay Area) are progressive policies that will alleviate the 'housing shortage'. (click image to enlarge)

SF Housing Bubble #2

Housing 6X US Avg.

|

| http://www.businessinsider.com/crazy-things-people-do-to-survive-san-franciscos-housing-prices-2016-4/#this-housing-flyer-will-give-you-a-better-idea-of-how-crazy-rental-prices-are-4 |

Housing Price Increases

% Each Year 1988 - 2016

% Each Year 1988 - 2016

Summary:

Nationwide, rents have gone up faster than incomes. This is a temporary economic shock. It will be resolved by a stabilization in rents/prices once the housing construction started several years ago comes online.

Foreign direct investment is increasing price pressure but that also may be at a peak.

Long term, better transit is needed in the metro SF Area as population increases are likely to continue. BART connections to job centers like Sunnyvale, Cupertino, Mountain View would relieve a lot of the traffic jams.

The South Bay cities should cooperate to locate future business expansion nearer to where people commute from, like San Jose and the East Bay.

Companies could do much to alleviate the costs and stress of long commutes by expanding outside the SF Bay Area in places like the Mid-West and South East US.

There is a thought that over-building housing will reduce rents and that this is desirable. It. Will. Not. Work. (Unless you want a 2007-2008 housing-wage-employment crash. You don't.) Riccardo established this in the early 1800's. C.f. "Nominal Wage/Price Rigidity" see more in https://en.wikipedia.org/wiki/Nominal_rigidity

Discussion:

|

| Solution to "Housing Crisis"? |

|

| Who cares about commuting when you can play Scrabble?! |

Urban Economics:

The "standard model" in urban economics fairly accurately predicts that density and therefore rents are highest at the center of economic activity. This graph is worth showing again:(click graphic to enlarge)

Housing Costs Go Down as Distance

from City Center Goes Up (Theory)

|

| The Economics Theoretical Model |

Housing Costs Go Down as Distance

from City Center Goes Up (Actual)

|

| The Economics Model matches Reality very well. |

New York Residents Pay More to be

Close to Public Transit.

In the SF Bay Area we see the same thing. The further from SF you are, the lower the rents. Here are the rents for a 2 bedroom apt. in these cities (as of 1/7/2017):

San Francisco - $4,487

Palo Alto - $3,816

Mountain View - $3,549

Cupertino - $3,222

Sunnyvale - $3,173

Fremont - $2,500

Livermore - $2,093

Increased density makes land more valuable which in turn raises rents further. Individuals who challenge this essentially are arguing increased density lowers rents. When I ask how do they explain lower Manhattan (i.e., high prices and high density)? This invariably results in a pause. They often stare out the window for a minute or two. Then they usually say something like "oh yeah - huh" and change the subject. Increased density will not decrease rents.

Low Rent Housing?

1940-2013 NYC Rents - Up 28X

Nationwide Rents - Up 10X

Adding housing, even low-income housing, reduces the amount of land for development making the remaining land more valuable thereby raising housing costs.

We can see this in the current building boom in major urban cores around the country:

"Two, three years ago, vacancies were super low, and rent growth was super high," said Hans Nordby, managing director at CoStar to Fortune. That led to a boom in luxury real estate—but "it's so expensive to build in a lot of the markets, that builders can't build affordable housing."

http://fortune.com/2016/08/16/recession-risk-luxury-apartments/

The standard urban economic model implies that people live where they live because they want shorter commutes. But this is less true for the South Bay. Looking at Sunnyvale, CA over 2002 to 2014 shows this clearly. Over time, the number and percentage of those living AND working in Sunnyvale decreased!

As competition for housing near job centers in Cupertino (Apple) and Mountain View (Google) increased, young single people sharing houses and senior executives out-bid middle and lower income families who wanted single family homes. The result was that more people commuted to Sunnyvale from places like Livermore and Morgan Hill because they could afford a Single Family House (SFH) there which they couldn't afford closer to work. People prefer a SFH and will do what it takes to get it, despite difficult commutes (detail here: http://meetingthetwain.blogspot.com/2016/12/live-work-commute-1.html)

The relevant graphics (from the US Census Bureau) are worth showing again - first 2014, then 2002:

(click graphic to enlarge)

|

2014: 75,000 Commute In,

8,700 Live/Work In, 57,000 Commute Out |

|

| 2002: 68,000 Commute In, 9,500 Live/Work In, 49,000 Commute Out |

- the number who lived AND worked in Sunnyvale went DOWN.

- Every job added in Sunnyvale = another worker commuting IN.

- Every additional worker living in Sunnyvale = another worker commuting OUT.

So everyone is commuting from everywhere to everywhere. The main increase in commute-IN locations TO Sunnyvale were from Morgan Hill, Livermore, and other more remote places where a single family detached house is affordable.

(cf. http://meetingthetwain.blogspot.com/2016/12/live-work-commute-1.html .).

I still read people saying more housing near workplaces are needed so people can walk and bike to work. This despite the census data showing that nationwide almost no one walks (2.8%) or bikes to work (0.6%) and the numbers have been going down for many years! For more on this see:

http://meetingthetwain.blogspot.com/2017/01/live-work-commute-3.html

ADUs ("Granny Houses"):

|

| Hip Granny! |

What actually happens is that the income from the ADU raises the value of the main house making it more expensive. For example, a potential seller sees the $2,000/month income from an ADU and calculates that whereas before buyers could afford a $6,000/month mortgage, with the ADU rental income they can afford a $8,000 mortgage. This raises the mortgage a buyer can afford from $1.2M to $1.6M. So the seller raises the price of the house to capture that extra value. Even houses without ADUs rise in price because the potential for the rental income from an ADU raises the perceived value.

Despite the best efforts by government to make it easy to put in an ADU, they have not caught on in the SF Bay area. People like having the privacy of a back yard for barbecues and a place for kids to run around in without some stranger watching. Back yards in this area aren't very big and having a tenant hearing you discuss matters with your spouse does not appeal. In addition, the additional parking fills up the streets and annoys the neighbors. The extra money just isn't worth it.

Tech Growth:

The huge and fast growth in tech has sent several trillion dollars to Silicon Valley from around the world in the last few years. Just the top seven SF Bay Area cos. made over 1/2 a trillion dollars in revenue in just 2016 alone.Apple - $233B

Google - $75B

Intel - $56B

HP - $48B

Cisco - $49B

Oracle - $37B

Facebook - $28B

------------------------

Total = $526 Billion = over 1/2 $Trillion

Add to that lots of smaller companies scattered around the area and we are looking at enormous amounts of money coming into local company accounts. Much of that has to be paid to suppliers overseas and in other parts of the US, but still an enormous amount went into hiring engineers, marketers, and various other support staff locally. Nearly 500,000 jobs were added to the region in five years from 2009 to 2014. This is the main cause of the housing price increase. It is NOT a problem of not enough housing, since we are not talking about housing the homeless. It IS the upward pressure of bidding on housing that has raised the price of near in properties more than some people can afford so they commute longer distances.

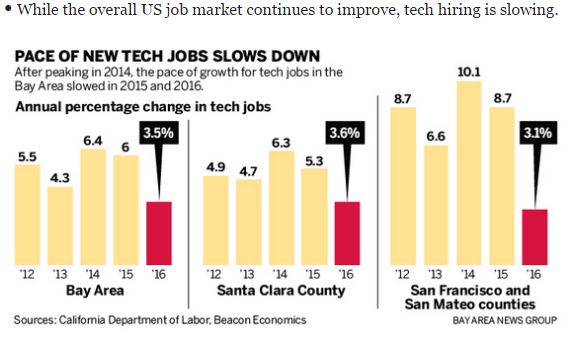

But "trees don't grow to the sky" and the SF Bay Area job market seems to be cooling down. (click image to enlarge)

From an article on Seattle's growth:

"There are also now more than 80 engineering centers in the Seattle area operated by big tech corporations, like Facebook, Alibaba, eBay and others. These companies have set up shop in the Northwest to mine the region’s pool of tech talent. This kind of employment growth is a key factor in driving up home prices.

Portland Mortgage = Half Sunnyvale Rent

$1,437 to BUY 4BR in Portland vs $4,500 to RENT in Sunnyvale?

$1,437 to BUY 4BR in Portland vs $4,500 to RENT in Sunnyvale?

From: http://www.geekwire.com/2016/seattle-maintains-status-nations-hottest-housing-market-due-relentless-tech-job-growth/

The following table shows very high growth in housing prices in Portland and Seattle while the San Francisco Metro Area grows slightly below the national average (click on table to enlarge):

Housing Cost 1-Year Increase by Metro Area (Oct. 2016)

SF Up 5.5%,

US Avg. Up 5.6%,

Seattle/Portland Up 10%

As a result, housing prices in Seattle and Portland are rising faster. San Francisco and New York, where rent increases hit first, have pretty much stabilized. Because of nominal price rigidity, rents and prices will not decrease significantly, unless there is a severe economic downturn.US Avg. Up 5.6%,

Seattle/Portland Up 10%

C.f., https://en.wikipedia.org/wiki/Nominal_rigidity

Chinese Investment:

The main cause of the rapid increase in housing prices is the rapid increase in well-paid tech workers, but another cause is foreign investment. This is a compliment to the US's relatively sound legal system, environmental safeguards, individual freedom, and lack of corruption. But the investment is overly concentrated in NYC, LA, SF, and Silicon Valley.

Chinese Foreign Direct Investment (FDI)

$21B to $139B - 600% - in 10 years

|

| http://www.ey.com/cn/en/services/specialty-services/china-overseas-investment-network/ey-going-out-the-global-dream-of-a-manufacturing-power-2016-china-outbound-investment-outlook |

"...The common view in the US now — the Chinese are, like the Japanese before, buying at the top of the cycle. Prices have reached a point where some deals no longer make fundamental economic sense. At current prices, many buildings being marketed to Chinese have negative leverage."

https://www.linkedin.com/pulse/chinas-booming-investment-us-real-estate-huge-new-force-fuhrman

Driving demand is a sudden influx from China's massive foreign currency reserves. $4 trillion went to China from around the world over many years. In the two+ years 2014 - 2017 about $1 Trillion left China seeking stable secure investments in property. This went to the US, Canada, Australia, etc. to find a safe place to invest. China's foreign exchange reserves have stabilized at around $3 Trillion as a necessary amount to have on hand to engage in foreign trade. (click image to enlarge)

China's Foreign Exchange Reserves

2014 = $4 Trillion, 2018 = $3 Trillion

|

| https://tradingeconomics.com/china/foreign-exchange-reserves |

We saw this before when Japanese investors bought up a lot of property and companies for investment purposes then lost their shirts when the bubble (that they created) burst.

Dollars can't be spent in China or Japan. Chinese companies pay suppliers and workers in their own currency, Yuan, so excess dollars going to China must go back to the US to buy something. They buy real estate. Americans who sent so many dollars overseas should not be surprised to see it coming back. (click image to enlarge)

Where the Real Estate Money Goes

NY, LA, SF

(Don't confuse this influx of big investment money from gigantic banks and investment cos. with Chinese immigrants who are by and large just average middle class people trying to live a decent life in a free country and struggling just as much as anyone to afford it.)

Many of those big investments are in property in desirable places in the San Francisco area. https://www.nytimes.com/2015/11/29/business/international/chinese-cash-floods-us-real-estate-market.html (click image to enlarge)

Chinese Investors Pay 60% More

Than Other International Buyers

Than Other International Buyers

Seattle has also attracted a lot of Chinese investors: "Matthew Moore, Juwai’s president of the Americas, said the site’s data showed two-thirds of Chinese buyers cited education (typically for their children) as their primary motivator for choosing Seattle. That was followed by lifestyle and travel opportunities (favored by 24 percent of buyers) and investment potential (16 percent)."

http://www.seattletimes.com/business/real-estate/seattle-becomes-no-1-us-market-for-chinese-homebuyers/ (click image below to enlarge)

Real Estate Sales to non-US Clients

|

| https://www.linkedin.com/pulse/chinas-booming-investment-us-real-estate-huge-new-force-fuhrman |

The rise in Chinese foreign investment overseas is partly a reaction to the decline in the value of the Yuan compared to the dollar. Until 2013 the dollar was getting cheaper relative to the Yuan so it made more sense for big investment agencies to hold Yuan. In 2013 that reversed and the Yuan started losing value relative to the dollar. This made holding American dollar-denominated real estate a better investment than Chinese real estate, if only for exchange rate purposes. (click image to enlarge)

2013 Yuan-Dollar Reversal in Red Circle

Chinese investments are also bidding up their own property - as much as doubling the price in just 4 years. (click image to enlarge)

Chinese Property Rising

Not surprising since average wages in China have more than doubled since 2008 (click image to enlarge)

Chinese Wages 2008 - 2017

254% Growth in 10 Years

|

| https://tradingeconomics.com/china/wages |

Chinese Investment in UK $29Bn

|

| http://www.bbc.com/news/business-34542147 |

London Housing Market Soars

Overall UK Market Flat

The American rich and near-rich are doing the same in Europe as the Euro has become a lot cheaper in dollar terms. https://www.nytimes.com/2015/11/12/your-money/stronger-dollar-emboldens-more-americans-to-seek-european-dream-home.html?_r=0 (click on image to enlarge)

Italy - Tuscany Villa

|

| (click on image to enlarge) |

Foreign investors from Monaco to Australia are using places like NY City as a place to stash spare cash: "And so New Yorkers with garden-variety affluence—the kind of buyers who require mortgages—are facing disheartening price wars as they compete for scarce inventory with investors who may seldom even turn on a light switch. The Census Bureau estimates that 30 percent of all apartments in the quadrant from 49th to 70th Streets between Fifth and Park are vacant at least ten months a year." http://nymag.com/news/features/foreigners-hiding-money-new-york-real-estate-2014-6/index1.html

Supply and demand working as predicted; more money = more demand = higher prices.

This flood of foreign exchange won't last forever. The Chinese govt. has been trying for months to stop it with some success. Even if the govt. can't stop it, there is a finite amount of money in China's Foreign Exchange Reserves so the flow will end in another year or two, if not earlier.

Tokyo Housing Prices:

Tokyo has been mentioned in a Financial Times blog as an example of where increased building does not drive up prices. This is simply wrong as a simple Google search on "Tokyo housing prices" shows. Tokyo has also seen an influx of Chinese money looking for a secure investment in a non-corrupt country. (click graphic to enlarge)

Tokyo Condo Sale Prices Rise Sharply

Note that in the above graph, prices start accelerating in 2013 when the Yuan stopped appreciating in value.

“There are so many Chinese buyers recently,” said Song Zhiyan, a broker at BestOne Co.realty in Ikebukuro, ... “I only work with clients who can pay cash. Why waste everyone’s time?”

"She tells them to hurry: Properties are gone so fast that those who try to negotiate the price find them already sold. Her transaction volume exclusively for mainlanders buying in Tokyo has tripled over the past six months..."

https://www.bloomberg.com/news/articles/2015-07-02/salarymen-sidelined-as-chinese-descend-on-japan-property-market

Not all the Tokyo housing price increase has been due to foreign investors. Much (most?) is due to a rising Tokyo stock market creating new millionaires who then look for a safe place to put their earnings.(click graphic to enlarge)

Average Tokyo Condo Price

At 24-Year High

|

| https://www.bloomberg.com/news/articles/2016-01-24/tokyo-boj-fueled-property-boom-prices-many-buyers-out-of-market |

|

| Japan's Stock Market Rise Starting Late 2012 |

http://www.japantimes.co.jp/news/2016/01/25/business/economy-business/boj-fueled-tokyo-property-boom-pricing-average-earners-housing-market/#.WKEeWm8rKUk

The following graphic shows a 40% increase in housing costs in the central 6 wards of Tokyo since 2012. In central Osaka, it was 45% over the last 4 years. Increased demand raises prices. (click graphic to enlarge)

40%-45% Increase in Condo Price in Main Japanese Cities

|

| http://japanpropertycentral.com/category/all/real-estate-news/ |

Several articles have cited Tokyo housing prices as an example of an area that hasn't increased in value while growing. The likely error on the journalist's part was not understanding the data. Tokyo city was merged with Tokyo prefecture in 1943. The data for Tokyo since then has always referred to the entire prefecture which is 845 sq. miles (larger than San Mateo County) and stretches into forests and mountains in the west. It is better to refer to the 23 ku ("wards") of old Tokyo city which are shown in the above graph.

Population peaked in the 23 ku of old Tokyo at 9M in 1965 and then decreased by 10% until recently. Many shoddy old houses from the late 1940s were torn down. Recently the population of the 23 ku have grown again, density is increasing, lots of higher quality housing is being built and prices are rising. The inner 6 wards increased most rapidly, followed by the next ring of wards, followed by the outermost wards. As always happens when you increase density.

More on Tokyo: http://www.newgeography.com/content/002923-the-evolving-urban-form-tokyo

More on Tokyo: http://www.newgeography.com/content/002923-the-evolving-urban-form-tokyo

One Housing Crisis Causes Another:

Since the end of the 2007 mortgage crisis, a lot of people have had to leave their houses - which they may not have been able to afford to begin with. This has put pressure on rentals. (click graphic to enlarge)

US Home Ownership Rate at 63%

50 Year Low: 1965 - 2016

As seen in the next graphic, housing prices have deviated from affordability enough that it looks a lot like the last real estate bubble. This suggests income and housing prices will converge again. (click graphic to enlarge)

Home Price Increase

Far Above Consumer Price Index

Far Above Consumer Price Index

1950 - 2017

The cost of owning is way out of line with rents suggesting a convergence is coming. Either prices come down (or go sideways for a while) or rents go up. Since there are limits to what people can pay it is more likely prices will come down. This is especially true as interest rates rise. If people pay more in interest they have less money to pay for the house.

House Price vs Rental Equivalent

At 24% divergence vs. 40% at height of housing bubble

The anemic recovery has put people to work but wages have not kept up. Factory workers becoming Uber drivers. Sociology majors becoming barristas. This is not sustainable and will eventually self-correct as housing keeps being built and job markets improve.

House Price Increase Far Exceed Wage Increase

1996-2018 Federal Reserve Data

The flip side of people losing their homes because of sub-prime mortgage defaults after 2007 is a decrease in rental vacancies as people are forced out of homes into rentals - see below. This forces up rents. (click graphic to enlarge)

US Rental Vacancies Lowest in 30 Years

Construction Not Keeping Pace:

Existing Home Sales Almost At 2007 Level

|

| Housing sales highest in 10 years |

So many builders and construction workers were battered by the sub-prime crash there has been a shortage of workers. Many workers went into other fields or retired. This has caused increases in wages which means increases in prices and not as much housing being built. (click graphic to enlarge)

Effects of Labor Shortage:

75% Builders Paying More for Labor

68% Raising Home Prices

|

| http://www.forconstructionpros.com/business |

"When work was scarce, some workers retired early and others switched careers, compounding concerns about an aging construction workforce. The median age of construction workers climbed to 40.4 in 2010 from 37.9 in 2000, according to The Center for Construction Research and Training."

http://www.chicagotribune.com/business/ct-construction-labor-shortage-0531-biz-20160531-story.html

|

| http://www.tradesmeninternational.com/news/the-construction-labor-shortage-where-did-all-the-skilled-labor-go/ |

Click on graphic below to enlarge:

2/3 Builders Report Labor Shortages

|

| http://harmonconst.com/construction-industry-labor-shortages/ |

"Eight years after the housing bust drove an estimated 30 percent of construction workers into new fields, home-builders across the country are struggling to find workers at all levels of experience, according to the National Association of Homebuilders. The association estimates that there are approximately 200,000 unfilled construction jobs in the U.S. - a jump of 81 percent in the last two years." http://www.reuters.com/article/us-usa-housing-labor-idUSKCN11C0F7

(click graphic to enlarge)

Houses/Person Far Below 1990 Rate

Housing is Cheap (Elsewhere)

Raleigh is the state capital of North Carolina. It is part of the Research-Triangle area near North Carolina State University. (click image to enlarge)

|

| North Carolina State Univ. |

Housing is not expensive by SF Bay Area standards. The average price for a house in the US is $230,000 so this house below ($986/month mortgage) is pretty close to average in the US as a whole. (click image to enlarge)

Raleigh, NC

|

| Rush hour? (click image to enlarge) |

Politically, North Carolina is a swing state having voted narrowly for Obama in 2008, and narrowly against him in 2012.

|

| Univ. of Michigan Law Quad |

Housing is not expensive either, compared to the SF Bay Area. (click image to enlarge)

Many are quite happy working and living there (they like having four seasons) but many tech jobs are in Silicon Valley so graduates of U. of Mich. often have to move. As do graduates of other universities such as U of Chicago, Northwestern, U. of Ill, Purdue, Wisc., Ohio, Minn., etc., etc.

Of course, other parts of CA aren't too expensive, either. $1,288/month mortgage for the 4-BR house below.

Maybe all the tech companies could get over the idea that the only engineers in the world are in Silicon Valley. We have the Santa Cruz Mountains on one side and SF Bay on the other. Land is at a premium. All the job growth and investment in Silicon Valley means this modest little home below costs 6 times the price of the house in Raleigh, NC, or Sacramento.

There is another dimension to the housing costs here. Foreclosures. The following are from Zillow for Raleigh and Silicon valley. The red dots show "For Sale", the blue dots mean "Foreclosure". This is Sunnyvale-Santa Clara.

Foreclosure (Blue) and For Sale (Red)

About Equal in Silicon Valley

|

| Sunnyvale-Santa Clara-Cupertino - Blue dots are foreclosures. Sad. |

Almost as many "foreclosure" as "for sale" (roughly 1-to-1). It doesn't take much to go from hero to zero here - from four bedrooms to sleeping in the back seat. Each blue dot means a family that was once so excited to move in to their own house is now out. Years of mortgage payments and property taxes and nothing left.

This is Raleigh. Ratio of sales to foreclosures is about 4 to 1. Salaries are a bit lower but "the living is easy."

Four Houses "For Sale" (Red)

for Each "Foreclosure" (Blue)

in Raleigh

|

| Raleigh-Durham & Research Triangle Park, North Carolina Blue dots are foreclosures. |

So what to do?

The problem is too many people here and too many houses elsewhere. A liberal-progressive policy would be to induce companies to open work centers where there already is plenty of housing at reasonable prices - either in the less expensive parts of CA (and add transit, please) or elsewhere in the country. Other things a liberal-progressive policy would try to do:

1. Increase recruitment and training for the building trades.

2. Continue construction in less dense (and therefore cheaper) areas and be patient while existing construction comes online.

3. Improve transit systems to open up lower-cost lower-density areas for housing to relieve congestion. BART is a very good investment though it takes years to come online.

Prices will correct soon on their own if the Fed and govt. keep the current backings for low interest rates, with help for those at the bottom of the economic ladder. (click image to enlarge)

P.S. If you are unclear on some of the above please check some of my other blog posts referenced at eh beginning of this blog post.

For now, this is ....