Does Sunnyvale Need a New Main Library?

|

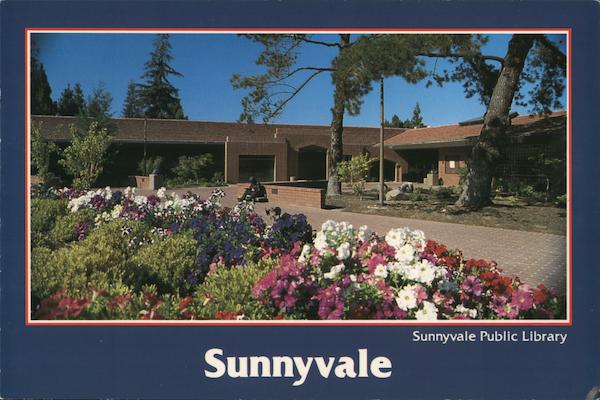

Sunnyvale’s lovely main library has been serving the community since 1961, through over 60 years of family use, weather and earthquakes. |

Summary

Sunnyvale (California’s 37th largest city) proposes a $290,000,000 bond (Measure E) to tear down the existing library and build a 120,000 sq. ft. new one, double the 60,000 sq. ft. of the current main library, making it the 7th largest library in the state. The 25 year bond at 4% will add $169M so total cost will be $459M.

(Ref: https://ca.countingopinions.com/pireports/report.php?e1af9d8fefa2ef3389ff88b2c9cdd028&live )

For an amazingly good AI-generated podcast summarizing this blog done by Google's NotebookLM, click on this link:

https://notebooklm.google.com/notebook/19a06bfb-24f5-48bc-b9cf-72744e062687/audio )

I love libraries. After I was elected to Sunnyvale's city council I was happy to vote for the new 20,000 sq. ft. branch library in north Sunnyvale which just recently broke ground (no new taxes required). I would support a new branch library, especially one for children like Palo Alto's (link opens in new tab).

|

| Interior of Palo Alto Children's Library https://library.cityofpaloalto.org/locations/C/ |

|

| US library patronage (blue lines) is down 50%. Physical circulation is down almost as much. Yet eBooks (gray lines) are soaring. (click on image to expand) Source: https://www.publishersweekly.com/pw/by-topic/industry-news/libraries/article/95383-the-quiet-crisis-facing-u-s-public-libraries.html |

|

| Sunnyvale peak usage was about 900,000 in 2008/2009. Current usage is 38% of that peak at 337,831 |

The proposed cost of over $2400/sq. ft. is well over double the cost of new libraries being built around California. That includes Sunnyvale's own new branch library which just recently broke ground at barely above $1000/sq. ft. New libraries in CA now (2024) are generally around $1000 to $1200 per sq. ft. (see "Cost Comparison" below). Even at $1200/sq. ft., adding on 60,000 sq. ft. by an addition would cost "only" $72M, saving $218M - we could do a lot with that for public safety, parks, schools, and helping those in need. The most expensive place for construction of offices (and libraries) is $1270/sf in NYC. (see https://www.clarisdesignbuild.com/2024-update-commercial-construction-cost-per-square-foot-in-the-us/).

As much as I love libraries, bigger is not necessarily better. All data on usage shows that easy access is absolutely the most important factor. For example, Fresno (population 520,000) has an 82,700 sq. ft. main library yet a branch library of only 22,000 sq. ft. has nearly double the circulation at only about 1/4th the size.

|

| Fresno's Woodside Branch Library 22,000 Sq. Ft. But nearly 2X the circulation of the 83,000 sf main library (click image to enlarge) |

Even smaller, at only 10,000 sf, Fresno's Fig Garden Branch had a circulation over 20% greater than the 8X larger main library. It is a rented commercial space in a strip mall - small, but kids and parents with strollers can walk to it, and it has easy parking for families. Access is key. More on these libraries here: David and Goliath (link opens in another tab).

To increase library usage, especially by kids and families, more branch libraries they can walk to is the answer, not gigantic monuments.

At the time of the first library bond proposal in 2007 (more at "History", below), local libraries were absolutely packed, even on week nights. It is dramatically different now. The change at the Sunnyvale and Santa Clara libraries is obvious. In room after room with seating for 28 or more, there are only 4 to 6 people. A desk that seats six has only one person, if that. Even on weekends, there is no shortage of seating - or parking.

If Sunnyvale wants to enhance library usage, the best way would be branch libraries in underserved areas (see "Alternatives", below), possibly sharing the cost and space of the nice libraries in the middle schools and high schools. Some cities do this with city librarians taking over after school ends and on weekends. A win-win for cities and schools!

Campaign Contributions

It is no accident that the biggest contributors to the "Committee to Support City of Sunnyvale Library Bond Measure" are architects in San Jose and San Francisco, and contractors to the city. In a weird little operation, the N. CA Carpenters PAC recently gave $5,500 to Charlsie Chang's campaign. She has no opposition so why does she need contributions? Anyway, as of this writing she has so far given $2,000 to the Support Sunnyvale Library Bond Measure campaign. C.f., City of Sunnyvale Electronic Filing System (netfile.com)

Cost Comparison

$290M for 120,000 sq. ft. = $2,417/square foot. That is well over twice the cost of Sunnyvale's new branch library in the Lakewood district (still under construction) which cost $23,000,000 for a 22,000 square foot library - just over $1,000/sq. ft. as reported in the San Jose Mercury News: https://www.mercurynews.com/2024/06/07/new-library-comes-to-north-sunnyvale-replaces-old-community-pool/

In 2022, Santa Cruz priced a new 38,000 sq. ft. library at $1,118/sq. ft. as reported here: https://lookout.co/measure-o-new-library-vs-renovated-library-what-would-santa-cruz-get/

Riverside is building a 15,000 sf library for $20M = $1,333/sf as seen here: https://riversideca.gov/library/about-library/new-spc-jesus-s-duran-eastside-library-building-project

In Contra Costa County Bay Point's new library of 21,000 sf will cost $20M = $952/sf as reported here: https://contracostaherald.com/contra-costa-county-library-awarded-9-9m-grant-for-new-bay-point-library/

A library is similar to an office, and in 2024, office space construction costs are highest in New York City at $1,270 per square foot

The big beneficiaries of this $290M bond will be big construction companies.

How Big Should a Library Be?

History

|

| Exterior of Camarillo's Library (click on photo to enlarge) |

as well as the libraries of Alameda, Calabasas, etc. and others here.

|

| Exterior of Calabasas' Library (click on photo to enlarge) |

Alternatives:

Sunnyvale City's website makes arguments about square feet of library space per resident, but that is a false argument because every library has a minimum requirement of entry way, help desk, hallways, etc. A city twice as large as another doesn't need twice as many entry ways, help desks, etc.

Even if we did want to increase the size of the main library, wouldn't it make more sense to simply add on to the existing library?

Destroying a perfectly good building instead of adding on is an environmentally destructive waste of money and material. We recycle food waste and bottles but trash perfectly good buildings? Adding rooms, amenities, solar panels and insulation to the existing building as we do to our homes is far better than trashing a fine old building. The saved money could be far better spent helping the homeless, providing better roads, and public safety.

Sunnyvale residents can and do check out books, eBooks and media from all community libraries near home and work at no charge. Is it worth $290,000,000 just to say “my library is bigger than your library” ?

Sunnyvale’s city council needs to pay less attention to what builders and construction unions want and more to what Sunnyvale really needs.

|

| St. Gallen Abbey Library, Switzerland Maybe cheaper than the over quarter $Billion Measure E? |