PermaLink:

https://meetingthetwain.blogspot.com/2017/12/prop-13.htm

Prop 13

I was listening to some "housing advocate" give a talk and she suddenly mentioned Prop 13 (which limits growth in property tax). It was the same old stuff about California schools needing the repeal of Prop 13. It was totally irrelevant to her point so I guess it was just "virtue-signaling" to the crowd (

"I am one of you"). It suddenly hit me that if there were no Prop 13 things would change dramatically - possibly against the

build-build-build crowd.

Prop 13 Limits Voter Anger at Rising Density

Right now property owners look at their house

doubling in value in 7 years (from Sep-2011 to Sep-2017 in blue line in chart below) and think "Wow! (But I don't like the traffic)."

But, if they saw their property tax double along with its value they would be up in arms, taking over city councils, storming Sacramento. We would be hearing about teachers, nurses, and seniors being forced out of their homes. A daily feature in the papers would be stories of long term residents having to give up their family, friends, and jobs to move to Nevada because they couldn't keep up with the property taxes.

And things would get even worse for renters than it is now since the property tax on apartment buildings would increase dramatically as well and that would be passed on in the form of even higher rents. As it is now, only renters feel the pain of rising property values and they don't vote much.

Eliminating Prop 13

might favor the

build-build-build crowd if people could be convinced that more housing would lower property values (and thus taxes). In that case, home owners might favor increasing density and accepting worse traffic.

But what if instead, people realized that increased housing density is just serving local tech companies to bring in and house more employees which in turn raises the cost of housing? In that case, there would be a big backlash against development as serving only the interests of the tech giants. Many

already make that connection as seen in many comments from around the country on SF Bay housing costs in the NY Times found here (under "Readers' Favorites"):

http://meetingthetwain.blogspot.com/2017/12/readers-comment-on-nyt-article-on-sf.html

In that case, instead of giving anodyne talks to the public, the "housing advocate" might need an unlisted number and gated housing.

In a sense, Prop 13 is 'rent control' for homeowners and ultimately protects the companies that feed the SF Bay area growth. It mitigates the effects of development on homeowners and thus disengages the most politically active voters from vigorously protesting the increase in traffic and congestion, that currently drives renters out of the area. Instead of protesting, homeowners pack up and leave, made easier by the increased value of the property they sell - sort of a relocation package. If it weren't for immigration via H1-B visas and other means, California would have been losing population since the 1970's. C.f.,

http://meetingthetwain.blogspot.com/2017/04/limits-to-growth.html

Moving On

That housing advocate should be thanking prop 13 for making her job easier in promoting increased housing density.

Prop 13 and School Funding and Student Performance

One could fill volumes about Prop 13 and schools but I will limit myself to a few items.

First of all, the CA courts ruled in Serrano vs. Priest that depending mainly on property taxes to fund schools was inherently unfair to poorer kids since their neighborhoods had less money from property taxes. (

https://en.wikipedia.org/wiki/Serrano_v._Priest)

This put the burden on the state. So even if Prop 13 were repealed entirely, more tax money for schools wouldn't come primarily from property taxes anyway, per the courts. If you want more money for schools, the state legislature needs to do some shifting around of priorities or ask for more money from the voters. Google Prop 98 (guaranteed percentage goes to schools) and Prop 111 (complexifies Prop 98 a

lot) for more on that.

Second, more money may

not mean higher educational achievement.

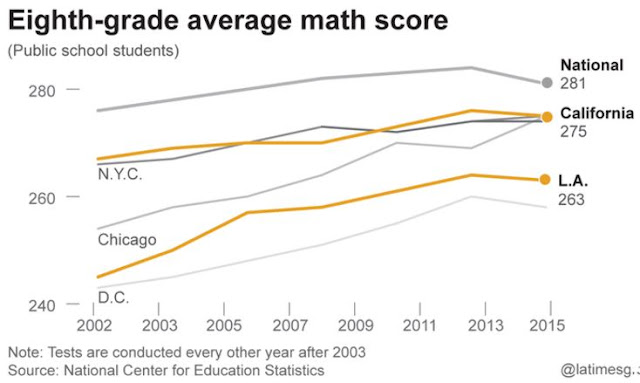

NY City and Washington, DC spend roughly 2 times and 1.7 times as much per pupil, respectively, as CA. (click on graphic to enlarge):

Spending per Student

NYC = $20,000

Washington, DC = $17,000

Chicago = $13,000

Los Angeles = $11,000

New York City spent $20,226 per pupil, CA about $10,000

But

CA students are about on a par with NYC students and are way above DC students. DC students score at the very bottom of the NAEP tests ("The Nation's Report Card") despite the huge amount spent on them. See chart below.

That NYC and DC spend much more money than CA yet have similar or worse educational attainment means dollars spent per child can't be a factor in measured educational attainment. So perhaps "throwing money at it" isn't really the major factor.

You need to

compare similar demographics, not just entire populations.

Each state has a different mix and demographics is a huge factor in educational performance. More important than overall state test scores is demographic improvement relative to national norms. There CA is doing okay, maybe even better than okay.

The demographics of California school children have changed a lot in the last few decades. The percentage of white children in schools has gone from slightly above 50% down to about 25% while Hispanics have gone from about 28% to over 50% of the school population. See chart below:

If you correct for the demographic changes, the nationwide test results look a lot better as seen below:

Red line (below) = scores if CA demographics hadn't changed.

Blue line = scores with current demographics.

As another example, from 1992 to 2011, Black students in CA improved from below the national average to slightly above the national average for Black students although both groups improved considerably. (click on graph to enlarge).

CA black students catch up with and pass black students nationwide.

Should schools have more money? I would certainly prefer that over some other things like High Speed Rail, but I'm not sure how much more money, and what good it would do given the poor correlation between money and educational attainment once you take demographics into account.

Prop 13 - Home Owners vs. Commercial Property Owners

Turning to other effects of Prop 13, the California Legislative Analyst's Office published an exploration few years ago titled "Common Claims About Proposition 13". This is

available at

http://lao.ca.gov/Publications/Report/3497

Some interesting charts from that LAO report below:

Increase in property taxes when changing houses makes it harder to move.

Commercial and Residential Properties turn over at similar rates

Residential and Commercial Properties Reassessed Relatively Similarly

There's more in the LAO document cited above.

CA Taxes vs. Other States

How do CA property taxes as a percentage of state taxes compare to other states? A little less than average (seen below) but this is made up for by the above average state income tax:

|

Excerpt from

|

CA property taxes at 25% of state income are a little below the US average of 31% but not very much compared to Arkansas (18%), and Hawaii (17%). (The lowest is North Dakota at 11%, highest is New Hampshire at 66% - not shown here). The lower property taxes are made up for by the higher percentage of state revenue (32%) from income taxes compared to the US average (23%) (several states have no state income tax). So if you want more money for schools it is there in the CA state income tax revenue instead of property taxes.

Addendum 1/7/2018: Dan Walters points out that revenues have soared the last 10 years despite prop 13.

"The most eye-popping number, however, is the immense growth in property tax revenue — well over 50 percent during the last decade alone and about 1,000 percent since 1978, when Proposition 13 was overwhelmingly passed by voters.

"The Legislature’s budget analyst, Mac Taylor, points out that “the property tax has grown faster than the economy” since then."

...

"The Proposition 13 debate will continue, but arguing that it has undermined vital tax revenue is disingenuous, as the latest data prove."

More here:

https://ww2.kqed.org/news/2017/07/18/despite-proposition-13-california-property-tax-revenue-has-soared/

End Thoughts

What do

I think about Prop 13? The same thing I think about gravity. I don't have an opinion about gravity and I don't have an opinion about Prop 13. Every year there is some discussion about repealing or modifying it. Whenever anyone raises it, I answer "you have my permission to change it." Nothing ever happens. I doubt anything ever

will happen. I focus on other things.